As we move forward through the week, it is crucial to maintain a broad perspective and keep an eye on key market indicators that can provide valuable insights into the current economic landscape. Among these indicators, tracking the performance of the Nifty 50 index stands out as a particularly useful tool for investors and analysts alike.

The Nifty 50 index, also known as the National Stock Exchange Fifty, is a benchmark Indian stock market index that represents the performance of the top 50 companies listed on the National Stock Exchange of India (NSE). These companies belong to various sectors such as banking, automotive, information technology, and consumer goods, making the index a comprehensive reflection of the Indian economy’s overall health.

One significant aspect to consider when analyzing the Nifty 50 index is its performance in comparison to other key global indices, such as the S&P 500 in the United States or the FTSE 100 in the United Kingdom. By assessing how the Nifty 50 stacks up against these indices, investors can gain valuable insights into how the Indian stock market is faring relative to its international counterparts.

Another crucial angle to consider when analyzing the Nifty 50 is monitoring the movements of individual sectors within the index. Different sectors, such as banking, pharmaceuticals, or energy, can respond differently to market conditions, economic indicators, and global events. By tracking the performance of these sectors within the Nifty 50, investors can identify trends and opportunities that may not be apparent when looking at the index as a whole.

In addition to sector-specific analysis, investors should also pay attention to key economic indicators and events that can impact the Nifty 50’s performance. Factors such as GDP growth, inflation rates, interest rate decisions, and geopolitical developments can all influence the direction of the index. By staying informed about these macroeconomic factors, investors can make more informed decisions about their investments in the Indian stock market.

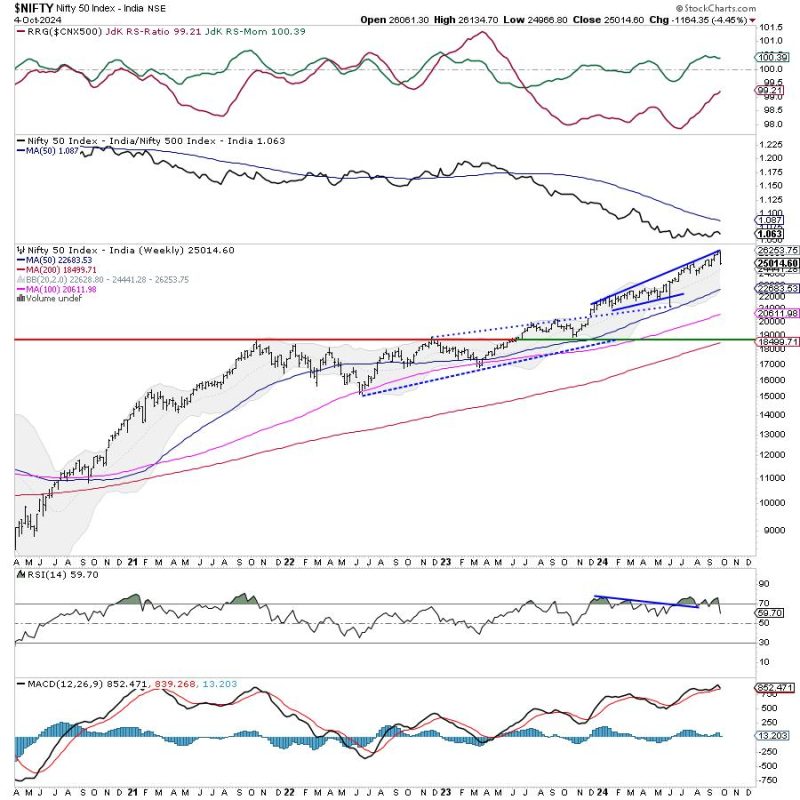

Finally, it is essential to keep a long-term perspective when evaluating the Nifty 50 index. While short-term fluctuations and market volatility are inevitable, focusing on the index’s overall trajectory over an extended period can provide valuable insights into the Indian economy’s underlying strength and resilience.

In conclusion, by analyzing the Nifty 50 index from various angles, including its performance relative to global indices, sector-specific trends, key economic indicators, and long-term trajectory, investors can gain a comprehensive understanding of the Indian stock market’s dynamics and make informed investment decisions. It is essential to remain vigilant and adaptable in the face of changing market conditions, leveraging the Nifty 50 index as a valuable tool for navigating the complexities of the Indian stock market landscape.