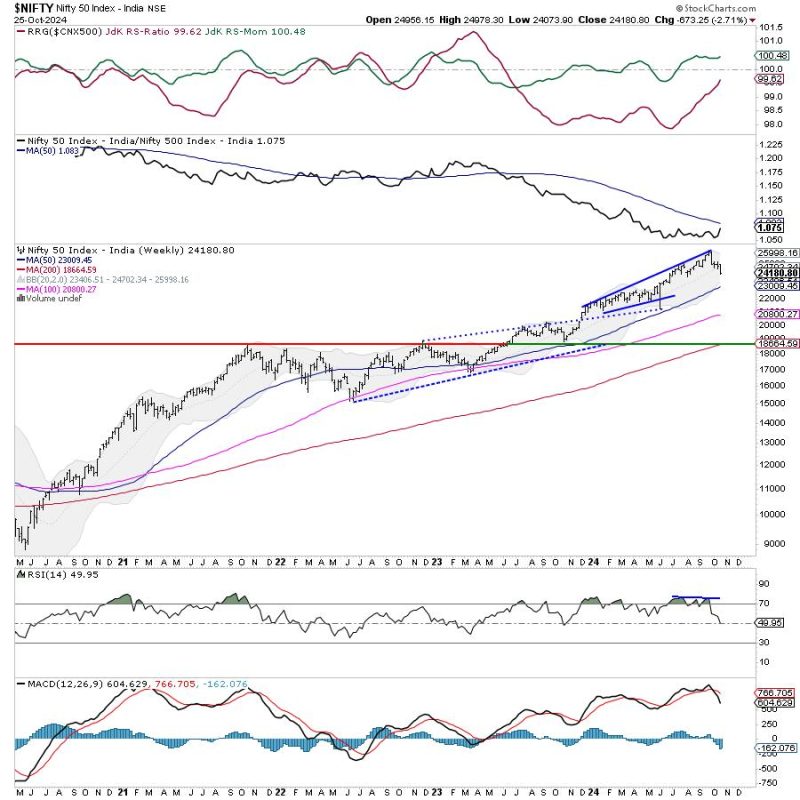

In the world of financial trading, investors and traders are constantly keeping a close eye on key support and resistance levels to gauge the market’s sentiment and potential future movements. The Nifty index, which measures the performance of the top 50 companies listed on the National Stock Exchange of India (NSE), recently violated key support levels, leading to a shift in market dynamics and investor sentiment.

The violation of key support levels is a critical event in technical analysis, as it often signals a change in the trend or momentum of an asset or market index. In the case of the Nifty index, the breach of these support levels has dragged the resistance levels lower, indicating a bearish outlook for the market in the short term.

Support levels are price levels at which a stock or index tends to find buying interest, preventing it from declining further. Conversely, resistance levels are price levels at which a stock or index tends to face selling pressure, capping its upside potential. When support levels are breached, it suggests that market participants are becoming more bearish, leading to further downside potential.

In the context of the Nifty index, the violation of key support levels has undermined investor confidence and raised concerns about the sustainability of the recent rally. The downward pressure on resistance levels indicates that buyers are reluctant to step in at higher price levels, leading to a lack of upward momentum in the market.

Traders and investors are now closely monitoring the market’s reaction to the violation of key support levels, as it could provide valuable insights into the future direction of the Nifty index. If the index fails to reclaim these support levels and continues to trade below them, it could signal further downside potential and a possible shift in the market’s trend.

Despite the bearish outlook in the short term, it is important for investors to remain cautious and vigilant in their trading decisions. Markets are inherently volatile and unpredictable, and it is crucial to have a well-defined risk management strategy in place to protect against potential losses.

In conclusion, the recent violation of key support levels in the Nifty index has led to a shift in market dynamics, dragging resistance levels lower and signaling a bearish outlook in the short term. Traders and investors should closely monitor the market’s reaction to these developments and be prepared to adapt their trading strategies accordingly to navigate the challenging market environment effectively.