In the world of finance, signals and indicators play a crucial role in guiding investors and traders in making informed decisions. The recent market developments have sparked a short-term bearish signal, causing investors to brace themselves for a week filled with significant news events. As market participants prepare to navigate uncertain waters, it becomes essential to understand the implications of this bearish signal and the potential impact it may have on various asset classes.

One of the key factors contributing to the short-term bearish signal is the anticipation of several important economic reports and events scheduled for the upcoming week. These include key data releases such as employment numbers, inflation figures, and central bank announcements. Any surprises or deviations from market expectations in these reports could potentially trigger increased volatility in the markets, leading to downward pressure on asset prices.

In addition to economic data, geopolitical events and macroeconomic trends also play a significant role in shaping market sentiment. Ongoing tensions between major global powers, trade disputes, and geopolitical uncertainties can all contribute to market volatility and trigger risk-off sentiment among investors. As uncertainties mount, investors tend to flock to safe-haven assets, such as gold and government bonds, which can further exacerbate the bearish signal in the short term.

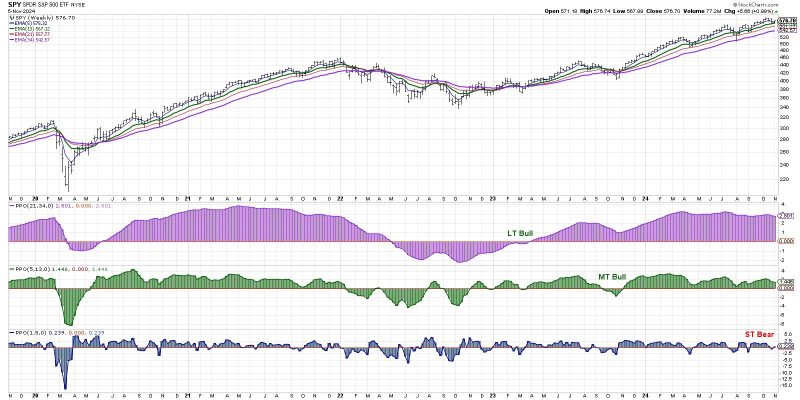

Another factor contributing to the bearish outlook is the technical analysis of market trends. Chart patterns and technical indicators are closely monitored by traders to identify potential trend reversals or continuation patterns. In the current market environment, technical indicators may be pointing towards a short-term correction or a pullback in asset prices. Traders who rely on technical analysis are likely to adjust their positions and risk management strategies in response to these signals.

Furthermore, market psychology and sentiment can also influence short-term price movements. Fear, greed, and herd mentality often drive market participants to make irrational decisions that can exacerbate selling pressure or trigger panic selling. In times of heightened uncertainty, it is essential for investors to remain disciplined, rational, and focused on their long-term investment goals, rather than succumbing to short-term market noise and emotions.

As investors brace for a news-heavy week filled with potential market-moving events, it is crucial to approach the situation with caution and vigilance. Diversification, risk management, and a long-term perspective are key principles that can help investors navigate through volatile periods and mitigate the impact of short-term bearish signals. By staying informed, disciplined, and adaptive, investors can position themselves to make informed decisions and seize opportunities that may arise in the midst of market turbulence.