In the world of investing, there is a constant ebb and flow that shapes the financial landscape. The past few years have seen a secular bull market that has continued to defy expectations, yet recent market trends are hinting at a major rotation that may impact investors across the board.

Traditionally, a secular bull market is characterized by a prolonged period of rising asset prices, particularly in stocks, typically accompanied by strong economic growth. This extended period of optimism and upward trends can instill confidence in investors, leading to increased risk-taking behavior and heightened market activity.

However, the current market environment is showing signs of a potential shift in sentiment. While the secular bull market may still be intact, there are clear indications of a major rotation occurring within various sectors and asset classes. This rotation is significant as it signifies a change in investor preferences and could impact portfolio performance and market dynamics moving forward.

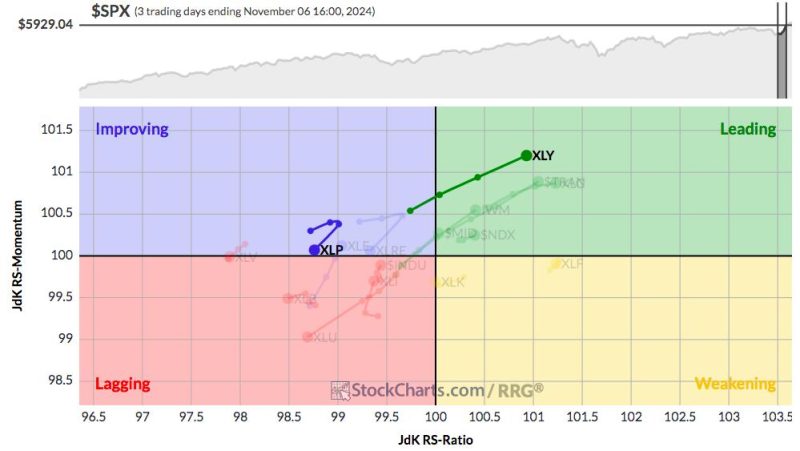

One notable aspect of this rotation is the movement away from high-growth and tech-oriented stocks towards more value and cyclical sectors. This shift suggests that investors are reevaluating their risk exposures and seeking opportunities in undervalued areas of the market that may benefit from economic recovery and inflationary pressures.

Additionally, geopolitical events and macroeconomic factors have contributed to the changing market dynamics. Uncertainties surrounding global trade, political tensions, and central bank policies have added layers of complexity to investor decision-making, prompting them to reassess their investment strategies and asset allocations.

As investors navigate through this period of transition, it is essential to maintain a diversified portfolio that can withstand market fluctuations and capture potential opportunities across various sectors. By staying informed about market trends, conducting thorough research, and seeking professional advice, investors can adapt to changing market conditions and position themselves for long-term success.

In conclusion, while the secular bull market continues to drive optimism and growth in the financial markets, it is crucial for investors to be mindful of the ongoing rotation and its implications for their investment portfolios. By staying vigilant, proactive, and strategic in their investment decisions, investors can navigate through changing market environments and strive for sustainable returns in the ever-evolving landscape of investing.