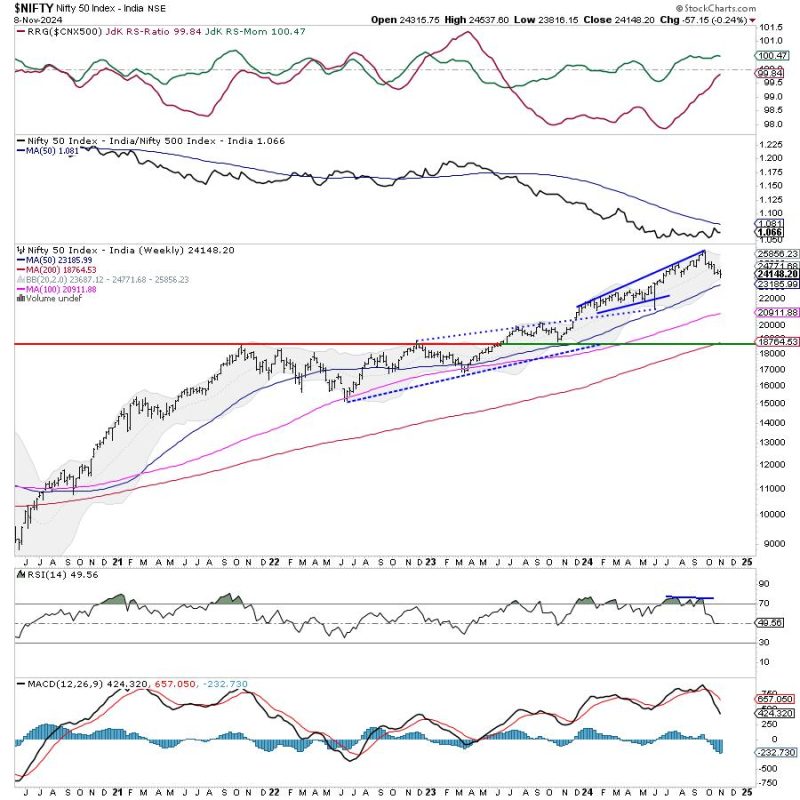

The week ahead for Nifty is likely to present a challenging scenario as the index continues to face resistance at multiple levels. Traders and investors need to be cautious as the market trend remains sluggish, hampered by a confluence of factors.

One of the key aspects impacting Nifty’s performance is the presence of several resistances in the current trading zone. This cluster of resistance levels poses a significant hurdle for the index to break out and gain upward momentum. It is essential for market participants to closely monitor these levels and assess the market dynamics before making any significant trading decisions.

Another factor contributing to the sluggishness in Nifty’s movement is the overall sentiment of the market. Uncertainty and volatility continue to prevail, influencing investor behavior and dampening market confidence. The lack of a clear trend or catalyst has added to the cautious approach adopted by traders, resulting in choppy and directionless price action.

Furthermore, global factors such as economic indicators, geopolitical tensions, and the performance of international markets also play a role in shaping Nifty’s movement. Any developments on these fronts can have a ripple effect on the domestic market, creating fluctuations and impacting investor sentiment.

In such a challenging environment, it is crucial for traders to exercise patience and remain vigilant. Adhering to risk management strategies, avoiding impulsive decisions, and conducting thorough analysis before entering trades are essential practices to navigate the current market conditions successfully.

As the week unfolds, it is advisable for market participants to keep a close watch on key support and resistance levels, monitor market developments, and adapt their trading strategies accordingly. By staying informed and agile, traders can position themselves to capitalize on potential opportunities and mitigate risks in the ever-evolving landscape of the stock market.