Investing in Tin Stocks: A Comprehensive Guide for Beginners

Understanding the Tin Market

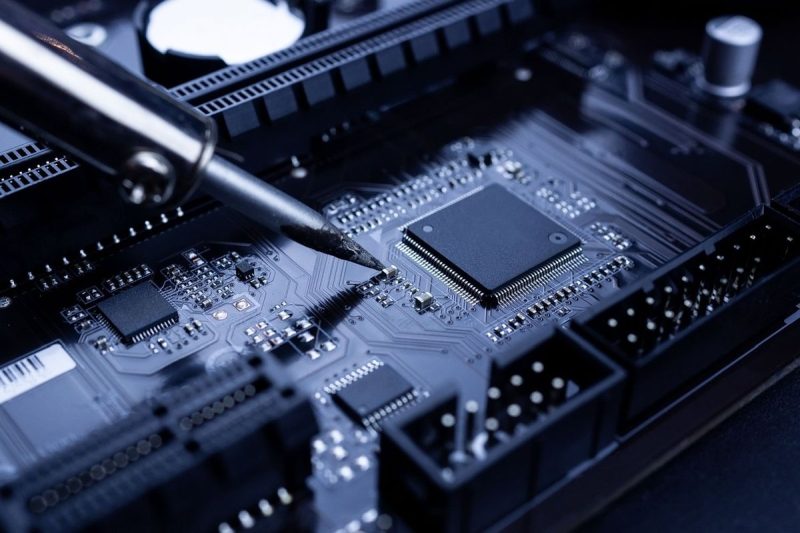

Before delving into how to invest in tin stocks, it is crucial to understand the dynamics of the tin market. Tin is a versatile metal with various industrial applications, making it an essential component in industries such as electronics, packaging, and construction. The demand for tin is driven by its unique properties, including corrosion resistance, malleability, and low toxicity.

Factors Influencing Tin Prices

Several factors influence the price of tin in the global market. One of the primary drivers of tin prices is the supply-demand dynamics. The limited availability of tin reserves worldwide, coupled with increasing demand, can lead to price fluctuations. Additionally, geopolitical factors, economic conditions, and technological advancements can impact tin prices.

Researching Tin Stocks

When considering investing in tin stocks, thorough research is essential to make informed decisions. Start by researching tin mining companies and analyzing their financial performance, production capacities, and growth prospects. Consider factors such as the company’s reserves, operational efficiency, and sustainability initiatives.

Diversification and Risk Management

Diversification is key when investing in tin stocks or any other asset class. By spreading your investments across multiple tin mining companies or other commodities, you can reduce the overall risk in your investment portfolio. Additionally, practicing risk management strategies, such as setting stop-loss orders and staying informed about market developments, can help mitigate potential losses.

Investment Strategies

There are various investment strategies you can adopt when investing in tin stocks. Long-term investors may consider a buy-and-hold strategy, focusing on companies with strong fundamentals and growth potential. Short-term traders, on the other hand, may capitalize on price volatility in the tin market through active trading strategies.

Monitoring Market Trends

Staying updated on market trends and developments is crucial for successful investing in tin stocks. Monitor tin prices, global supply-demand dynamics, and geopolitical events that can impact the tin market. Utilize financial news sources, industry reports, and market analysis to stay informed and make informed investment decisions.

Conclusion

Investing in tin stocks can be a lucrative opportunity for investors looking to diversify their portfolios and capitalize on the growing demand for tin in various industries. By understanding the tin market, researching tin mining companies, diversifying your investments, and staying informed about market trends, you can make informed investment decisions and enhance your chances of success in the tin market.