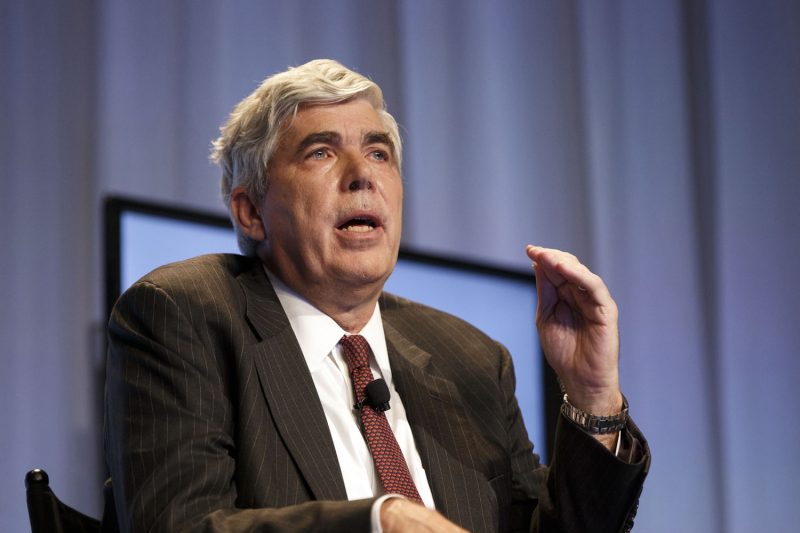

The recent charges brought against former WAMCO executive Kenneth Leech for fraud have brought to light yet another case of white-collar crimes that continue to plague the corporate world. Allegations of falsifying financial records and deceiving investors for personal gain highlight the need for stringent regulatory measures and ethical accountability in the business sector.

The accusations against Kenneth Leech underscore the significant impact such fraudulent activities can have on stakeholders and the public trust in companies. Investors rely on accurate financial information to make informed decisions, and when executives manipulate data for their benefit, the repercussions can be far-reaching.

Moreover, the case serves as a reminder of the importance of corporate governance and oversight. Companies must implement robust internal controls to prevent fraudulent practices and ensure transparency and accountability at all levels of the organization. Ethical conduct should be ingrained in the corporate culture, with zero tolerance for any form of misconduct.

The charges against Kenneth Leech also shed light on the role of regulatory bodies in detecting and prosecuting financial crimes. The Securities and Exchange Commission (SEC) plays a crucial role in monitoring the activities of corporations and individuals in the financial markets, aiming to uphold market integrity and protect investors.

In response to such cases, the SEC continues to enhance its enforcement efforts and collaborate with other agencies to combat fraud effectively. By holding individuals accountable for their actions and imposing penalties that deter future misconduct, regulatory authorities send a strong message that fraudulent behavior will not be tolerated.

Furthermore, the case of Kenneth Leech highlights the need for thorough due diligence and risk assessment in vetting executive candidates. Companies must conduct comprehensive background checks and scrutinize potential hires to mitigate the risks of bringing individuals with questionable ethics into their leadership ranks.

Ultimately, the charges against Kenneth Leech should serve as a wake-up call for both corporate leaders and regulators alike. Upholding high ethical standards, fostering transparency, and enforcing stringent regulations are essential pillars in maintaining the integrity of the business environment and safeguarding the interests of investors and stakeholders. It is only through collective efforts and a commitment to ethical conduct that we can prevent and address financial fraud effectively.