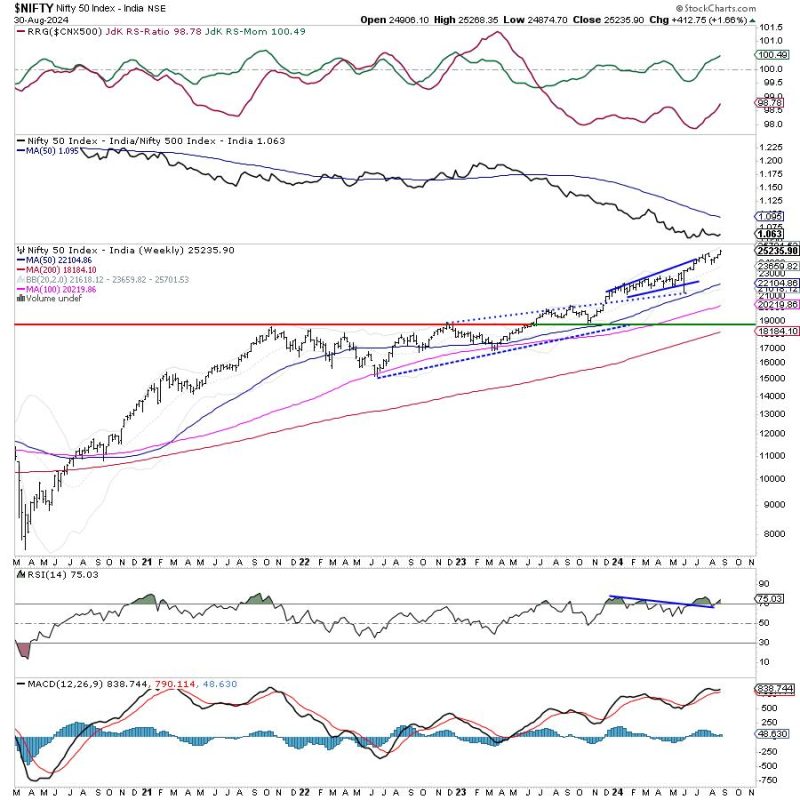

Heading Into the Week: Nifty Maintains Uptrend While RRG Signals Defensive Landscape

Technical analysis offers traders valuable insights into market trends and potential future movements. As investors gear up for the week ahead, the Nifty index appears to be holding strong in its uptrend, according to the latest analysis. Additionally, the Relative Rotation Graph (RRG) is signaling a distinctly defensive setup, highlighting potential areas of caution for market participants.

Nifty, which tracks the performance of the 50 largest and most frequently traded Indian companies, has managed to maintain its upward momentum. This trend bodes well for investors who have positioned themselves to benefit from this upward movement. The market sentiment seems positive, supported by various factors such as improving economic data and positive global cues.

Despite the overall bullish outlook for the Nifty index, the RRG chart is revealing a defensive positioning for certain sectors. This indicates that while the broader market may be trending higher, there are specific sectors that are showing signs of weakness or a potential downturn in the near future. Investors should pay close attention to these sectors and consider adjusting their portfolios accordingly to mitigate risks.

As the week progresses, market participants should keep a close eye on key economic indicators, upcoming corporate earnings reports, and geopolitical developments that could impact market sentiment. By staying informed and remaining adaptable in their investment strategies, traders can maximize their opportunities for success in the dynamic and ever-changing landscape of the stock market.

In conclusion, while the overall trend for the Nifty index remains upward, the RRG signals a defensive setup in certain sectors. Investors should exercise caution and stay vigilant in monitoring market dynamics to make well-informed decisions. By combining technical analysis with a broader understanding of market fundamentals, traders can navigate the complexities of the stock market with confidence and precision.