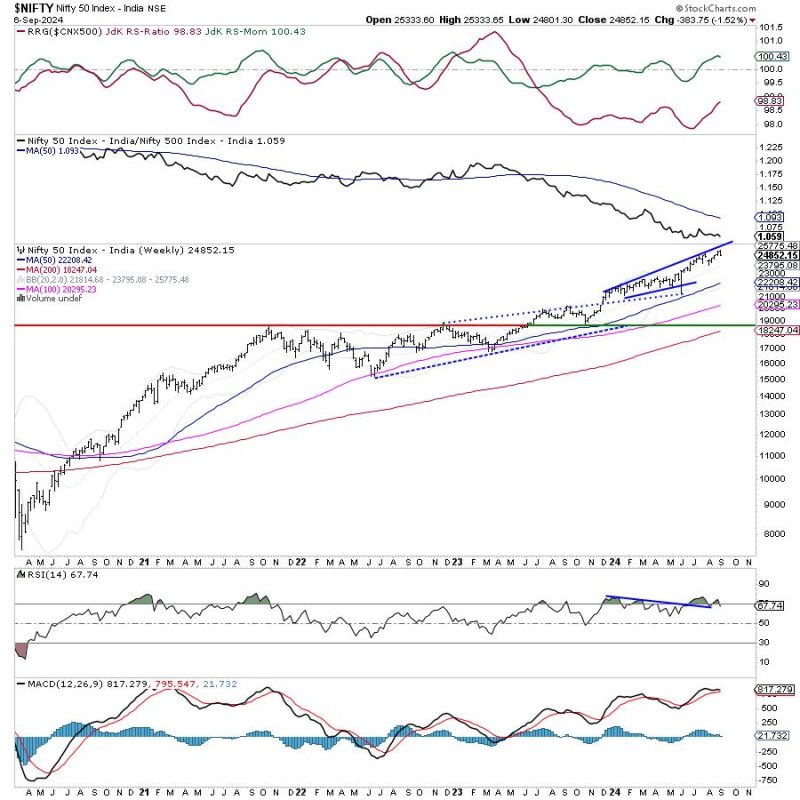

The recent market trends have raised concerns among investors as the Nifty index begins to display early signs of potential disruption in its uptrend. A cautious approach may be necessary to navigate the shifting landscape effectively.

Market analysts have observed certain indicators that suggest a potential deviation from the prevailing uptrend. Technical analysis reveals that the index may face resistance at key levels, signaling a possible reversal in the near future. This shift in momentum could challenge the existing bullish sentiment and prompt investors to reassess their strategies.

Furthermore, external factors such as global economic conditions and geopolitical events can also influence market dynamics. Volatility in international markets could spill over into the domestic market, causing fluctuations in stock prices and investor sentiment. It is important for market participants to remain vigilant and adapt to changing conditions to mitigate risks effectively.

Amidst the uncertainty, investors are advised to exercise caution and carefully monitor market developments. Implementing risk management strategies, such as setting stop-loss orders and diversifying portfolios, can help mitigate potential losses during periods of heightened volatility. Additionally, staying informed about market trends and developments through reputable sources can provide valuable insights for decision-making.

While the potential disruption of the uptrend poses challenges for investors, it also presents opportunities for those who are prepared to navigate market fluctuations effectively. By staying informed, maintaining a diversified portfolio, and adopting a prudent approach to risk management, investors can position themselves to weather the uncertain market conditions and capitalize on emerging opportunities.

In conclusion, the early signs of a likely disruption in the Nifty’s uptrend highlight the importance of adopting a cautious approach in navigating the market. By remaining vigilant, implementing risk management strategies, and staying informed, investors can position themselves to manage risks effectively and seize opportunities in a dynamic market environment.