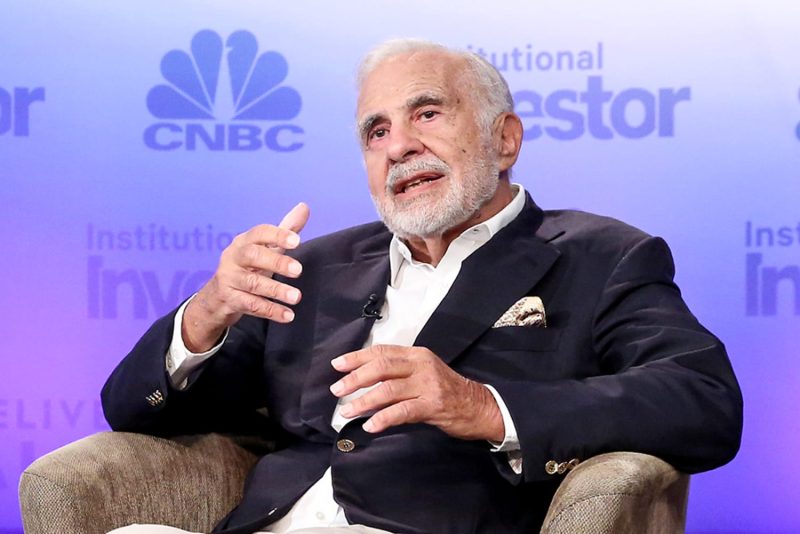

In a recent turn of events that has sent shockwaves through the financial world, the U.S. Securities and Exchange Commission (SEC) has brought charges against renowned billionaire investor Carl Icahn for allegedly concealing billions of dollars’ worth of stock pledges. This revelation has raised concerns about potential conflicts of interest and has cast a shadow over Icahn’s reputation as a successful and influential figure in the world of finance. The SEC’s allegations have prompted a closer examination of the intricate relationships between powerful investors, corporations, and regulatory bodies.

At the heart of the SEC’s accusations are complex financial dealings involving Icahn’s sizable stock holdings and his alleged failure to disclose crucial information to investors. The SEC claims that Icahn used his shares in a major energy company as collateral for significant personal loans, without adequately informing the public about these transactions. By doing so, Icahn allegedly violated regulatory requirements that aim to ensure transparency and accountability in the financial markets. The charges have prompted a closer scrutiny of the ways in which investors leverage their holdings for personal gain, and the potential risks that such actions may pose to market stability.

Icahn’s reputation as a powerful and outspoken investor has often made him a polarizing figure in the financial world. Known for his aggressive strategies and his willingness to challenge corporate leadership, Icahn has built a formidable empire based on his keen instincts and bold investment decisions. However, the SEC’s charges have raised questions about the extent to which Icahn’s financial activities may have been influenced by personal interests that were not fully disclosed to the public. This case serves as a cautionary tale about the importance of transparency and regulatory compliance in maintaining the integrity of the financial system.

The allegations against Icahn have drawn attention to the broader issue of corporate governance and the need for greater oversight of investors’ activities. As one of the most influential figures in the world of finance, Icahn’s actions have far-reaching implications that extend beyond his personal investments. The case highlights the importance of strong regulatory frameworks that can effectively monitor and enforce compliance with disclosure requirements, in order to prevent conflicts of interest and maintain investor trust. By holding high-profile individuals like Icahn accountable for their actions, the SEC sends a powerful message about the importance of upholding ethical standards and maintaining the integrity of the financial markets.

In conclusion, the SEC’s charges against Carl Icahn for allegedly concealing billions of dollars’ worth of stock pledges have shed light on the complex web of relationships that exist within the financial world. This case underscores the need for greater transparency, accountability, and regulatory oversight in order to safeguard the integrity of the markets. It serves as a stark reminder that even the most successful and influential investors are not above the law, and that adherence to ethical standards is crucial for maintaining the trust and confidence of investors. As this case unfolds, it will be important to closely monitor the regulatory response and the potential implications for corporate governance and investor relations in the future.