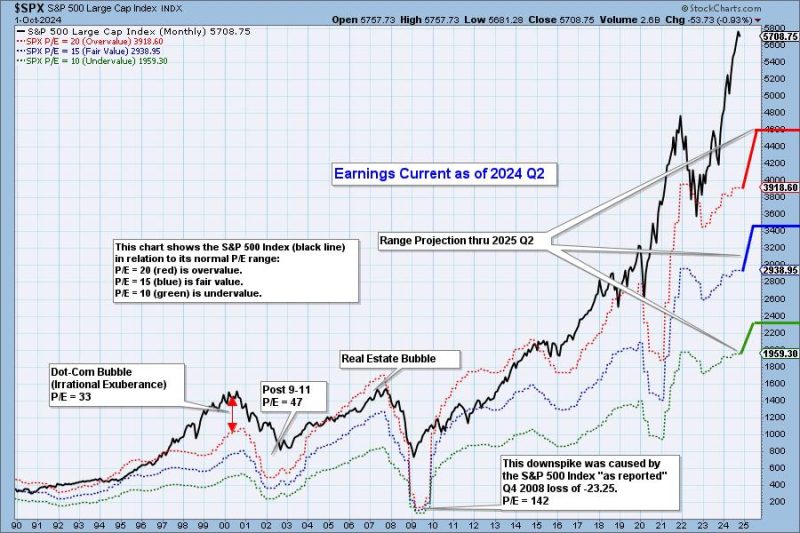

In a recent report published by GodzillaNewz, the analysis of 2024 Q2 earnings sheds light on the current state of the market, hinting at potential risks associated with overvaluation. As investors eagerly await the financial updates from various companies for the second quarter, it becomes imperative to understand the implications of an overvalued market and how it may impact investment decisions.

The assessment of 2024 Q2 earnings provides crucial insights into the performance of companies and their ability to meet investor expectations. However, what remains concerning is the overall valuation of the market, which appears to be stretched beyond fundamental levels. An overvalued market implies that stock prices are inflated relative to the underlying company performance, leading to a disconnect between price and value.

Despite the bullish sentiment prevailing in the market, driven by strong economic indicators and robust corporate earnings, the specter of overvaluation looms large. Investors need to exercise caution and conduct thorough due diligence before making investment decisions to mitigate risks associated with high valuations. While market exuberance can drive prices higher in the short term, it also increases the likelihood of a market correction or downturn in the future.

The overvaluation of the market amplifies the potential for downside risk, as prices may not be supported by strong fundamentals. It also raises concerns about market efficiency and the rationality of investor behavior, hinting at possible speculative bubbles that could burst unexpectedly. As such, investors are advised to adopt a prudent investment strategy that factors in the risks associated with overvaluation and focuses on long-term value creation rather than short-term gains.

Furthermore, the analysis of 2024 Q2 earnings serves as a reality check for investors, reminding them to look beyond quarterly results and consider the broader economic and market dynamics at play. While earnings reports provide valuable information about company performance, they should not be viewed in isolation but rather in the context of the overall market landscape.

In conclusion, the assessment of 2024 Q2 earnings highlights the importance of vigilance in a potentially overvalued market environment. By remaining cautious, conducting thorough research, and avoiding speculative behavior, investors can navigate the complexities of the market and position themselves effectively for long-term success. As the market continues to evolve, staying informed and adaptive is key to making informed investment decisions in a dynamic and unpredictable environment.