The Week Ahead – While Nifty Consolidates, Keep Head Above These Levels Crucial

1. Overview of Current Market Situation

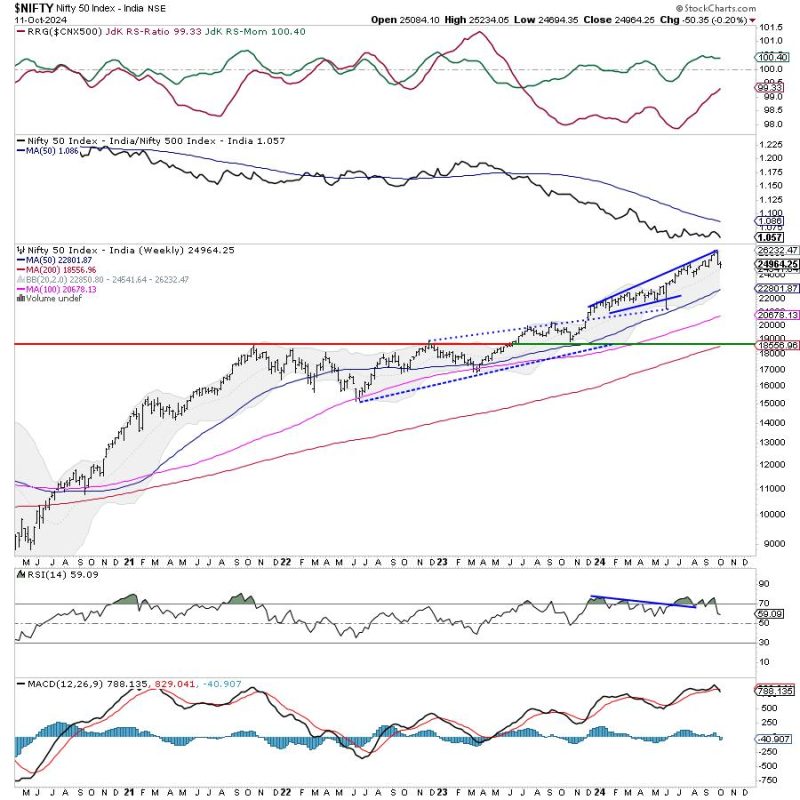

After a tumultuous few weeks for the Nifty, the market seems to be taking a breather as it enters a consolidation phase. The indices have been fluctuating within a defined range, showing signs of indecision among market participants. Amidst this uncertainty, it becomes crucial for traders and investors to stay vigilant and keep a close eye on key levels to navigate the market effectively.

2. Importance of Technical Levels

Technical levels play a significant role in guiding trading decisions, especially during periods of consolidation. These levels act as support and resistance zones, providing crucial insights into potential price movements. By identifying and monitoring these levels, traders can anticipate market behavior and adjust their strategies accordingly.

3. Key Support Zones to Watch Out For

One of the primary support levels to watch out for is the 15,600 mark on the Nifty. This level has been a significant support zone in recent sessions and continues to hold importance in the current scenario. A breach below this level could indicate further downside potential, prompting traders to reassess their positions and risk management strategies.

4. Resistance Levels to Keep an Eye On

On the upside, the 15,800 level stands out as a key resistance zone for the Nifty. If the index manages to surpass this level, it could signal a potential uptrend and open doors for further upside momentum. Traders should closely monitor price action around this level to gauge market sentiment and make informed trading decisions.

5. Volatility and Market Sentiment

Amidst the consolidation phase, volatility and market sentiment are likely to play a crucial role in shaping the direction of the market. Traders should be prepared for sudden fluctuations and sharp moves, which could test their risk management skills. By staying informed about market developments and monitoring key indicators, traders can better position themselves to take advantage of potential opportunities.

6. Risk Management Strategies

In such uncertain market conditions, risk management becomes paramount for traders and investors. Setting stop-loss orders, diversifying portfolios, and maintaining adequate liquidity are some of the key strategies to mitigate risks and protect capital. By following disciplined risk management practices, traders can navigate the market more effectively and enhance their long-term success.

7. Conclusion

As the Nifty consolidates and trades within a defined range, traders must remain vigilant and keep a close watch on key technical levels. By identifying crucial support and resistance zones, monitoring market sentiment, and implementing robust risk management strategies, traders can navigate the market successfully and capitalize on potential opportunities. Staying informed, disciplined, and adaptable are key tenets for success in the ever-changing landscape of the stock market.