In today’s rapidly advancing technological landscape, there is a notable buzz surrounding artificial intelligence and machine learning. One significant development that has caught the attention of investors is DeepMind’s AlphaFold system. This AI-powered software has demonstrated extraordinary capabilities in predicting protein structures, revolutionizing the field of bioinformatics. Investors are eager to explore opportunities to invest in AlphaFold stock and capitalize on its potential for growth.

Understanding AlphaFold and its Impact

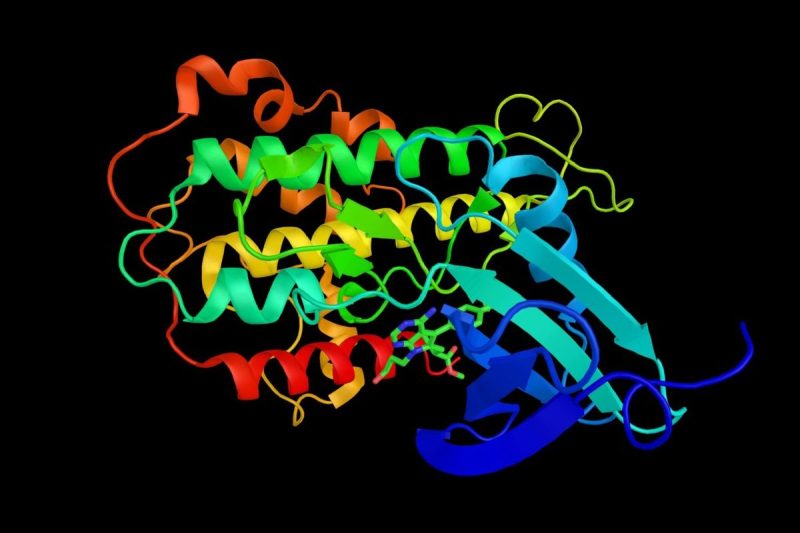

DeepMind, a subsidiary of Alphabet Inc., developed AlphaFold as a state-of-the-art tool for predicting protein folding, which is crucial for understanding biological processes and developing new drugs. By leveraging deep learning techniques, AlphaFold has achieved remarkable accuracy in predicting protein structures, outperforming other methods traditionally used in the scientific community.

Investing in AlphaFold Stock: Considerations and Strategies

For investors looking to capitalize on the promising potential of AlphaFold, several key considerations and strategies should be kept in mind:

1. Research and Due Diligence: Before investing in any stock, it is essential to conduct thorough research and due diligence on the company, its technology, market potential, and competitive landscape. Understanding DeepMind’s business model, financial health, and growth prospects is crucial when considering an investment in AlphaFold stock.

2. Long-Term Perspective: Investing in cutting-edge technologies like AlphaFold requires a long-term perspective. While the technology’s impact on the biotech industry is promising, it may take time for its full potential to be realized. Investors should be prepared for potential fluctuations in stock price and consider a long-term investment horizon.

3. Diversification: As with any investment, diversification is key to managing risk. Investors interested in AlphaFold stock should consider diversifying their portfolio to mitigate potential losses from any single investment.

4. Consultation with Financial Advisors: Seeking advice from financial advisors or experts in the field can provide valuable insights and guidance on investing in emerging technologies like AlphaFold. Professionals can offer personalized investment strategies tailored to individual risk tolerance and financial goals.

5. Monitoring Market Trends and News: Staying informed about market trends, developments in artificial intelligence, and news related to AlphaFold and DeepMind is essential for making well-informed investment decisions. Monitoring the performance of the stock and adjusting strategies accordingly is crucial for successful investing.

Conclusion

Investing in AlphaFold stock is a unique opportunity for investors seeking exposure to cutting-edge AI technology with significant potential to transform the biotech industry. By conducting thorough research, maintaining a long-term perspective, diversifying portfolios, seeking expert advice, and staying informed about market trends, investors can position themselves strategically to benefit from the growth of AlphaFold and capitalize on its disruptive potential in bioinformatics and beyond.