In the dynamic world of financial markets, investors are constantly on the lookout for cues that could potentially signal significant movements in the stock indexes. As we delve into the week ahead for the Nifty, it is anticipated that the market may largely trade within a range, with the possibility of trending moves only if certain key levels are breached. Traders and investors alike will need to closely monitor these edges to capitalize on potential opportunities and navigate the market effectively.

One of the key aspects that market participants will be closely watching is the support and resistance levels for the Nifty. These levels serve as important markers that help determine the overall direction of the market. If the Nifty manages to breach a significant resistance level, it could signal the start of a bullish trend, whereas a break below a crucial support level may indicate a bearish stance. Anticipating these levels and planning accordingly can help traders position themselves strategically to benefit from potential market moves.

Moreover, market sentiment and macroeconomic factors are also expected to influence the trajectory of the Nifty in the upcoming week. Positive news regarding economic indicators or corporate earnings could bolster investor confidence and drive the market higher. Conversely, any negative developments or geopolitical tensions could weigh on the market sentiment and lead to a downturn. Traders will need to stay informed and adapt quickly to changing circumstances to make informed trading decisions.

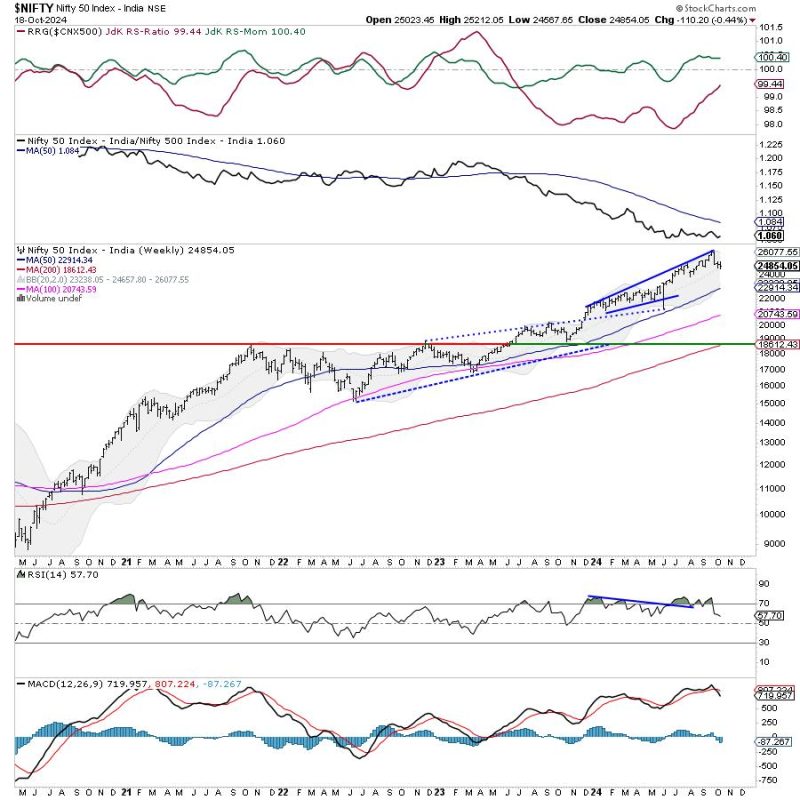

Technical indicators and chart patterns can also provide valuable insights into market movements. By analyzing indicators such as moving averages, relative strength index (RSI), and MACD, traders can identify potential entry and exit points in the market. Chart patterns like triangles, flags, or head and shoulders formations can offer clues about the future direction of the Nifty. By combining technical analysis with fundamental factors, traders can create a comprehensive strategy to navigate the market effectively.

Risk management is another crucial aspect that traders should prioritize as they navigate the Nifty in the week ahead. Setting stop-loss orders, diversifying positions, and maintaining a disciplined approach can help minimize potential losses and protect capital. It is essential for traders to assess their risk tolerance and establish a risk-reward ratio for each trade to make informed decisions and manage their portfolio effectively.

In conclusion, the week ahead for the Nifty is likely to be characterized by range-bound trading, with the potential for trending moves contingent on breaching key levels. By closely monitoring support and resistance levels, staying attuned to market sentiment and macroeconomic developments, utilizing technical analysis, and practicing effective risk management, traders can position themselves for success in the dynamic financial markets. Adapting to changing market conditions and maintaining a disciplined approach will be essential as traders navigate the intricate landscape of the Nifty in the upcoming week.