Investing in Chromium Stocks: A Comprehensive Guide for 2024

Understanding the Chromium Market

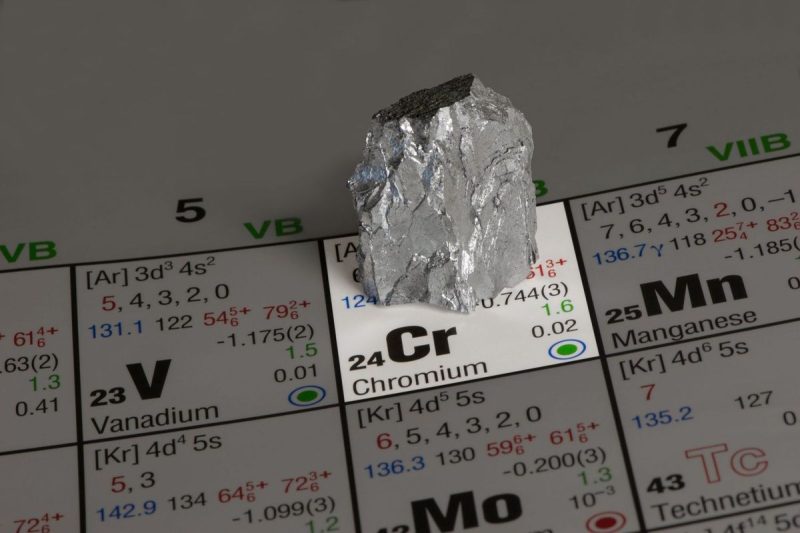

Chromium, a key industrial metal commonly used in stainless steel production, alloys, and other applications, plays a critical role in various industries worldwide. The demand for chromium continues to rise due to its essential properties, including corrosion resistance, hardness, and high-temperature strength. As an investor looking to capitalize on the potential growth in the chromium market, it is essential to have a solid understanding of the factors influencing the supply and demand dynamics of this key metal.

Factors Influencing Chromium Prices

Several factors can impact the price of chromium, making it crucial for investors to stay informed about market trends and developments. One significant factor is the global economic conditions, as demand for chromium is closely tied to industrial activities such as construction, manufacturing, and infrastructure development. Political instability, trade policies, and environmental regulations can also affect the supply chain and, consequently, chromium prices.

Technological advancements and innovations in the steel industry can drive the demand for chromium, especially as new applications and products requiring chromium emerge. Investors should monitor technological developments that could create new opportunities for chromium use, influencing its market value.

Identifying Top Chromium Stocks

When considering investing in chromium stocks, it is essential to conduct thorough research to identify top-performing companies in the sector. Some of the key players in the chromium market include mining companies involved in chromium extraction and production, as well as steel manufacturers that rely on chromium for their products. Evaluating the financial health, market position, growth prospects, and competitive advantages of these companies can help investors make informed decisions.

Diversifying Your Portfolio

Diversification is a crucial strategy when investing in chromium stocks or any sector, as it helps mitigate risks associated with market fluctuations. By spreading investments across multiple chromium stocks or related industries, investors can reduce their exposure to specific company or sector-related risks. Additionally, diversification can enhance the overall stability of a portfolio and improve long-term returns.

Monitoring Market Trends

Investing in chromium stocks requires ongoing monitoring of market trends, industry developments, and company performance. Staying informed about geopolitical events, regulatory changes, and technological advancements can help investors anticipate potential shifts in the chromium market and adjust their investment strategies accordingly. Regularly reviewing financial reports, quarterly earnings, and analyst recommendations can provide valuable insights for making well-informed investment decisions.

Risk Management

Like any investment, investing in chromium stocks carries inherent risks that investors should be aware of and prepared to manage. Volatility in commodity prices, changes in global demand, and geopolitical uncertainties can all impact the performance of chromium stocks. Implementing risk management strategies, such as setting stop-loss orders, diversifying investments, and having a long-term perspective, can help mitigate potential losses and protect investors’ capital.

In conclusion, investing in chromium stocks can offer lucrative opportunities for investors looking to capitalize on the growing demand for this essential industrial metal. By understanding market dynamics, identifying top-performing companies, diversifying portfolios, monitoring market trends, and implementing risk management strategies, investors can position themselves for success in the chromium market.