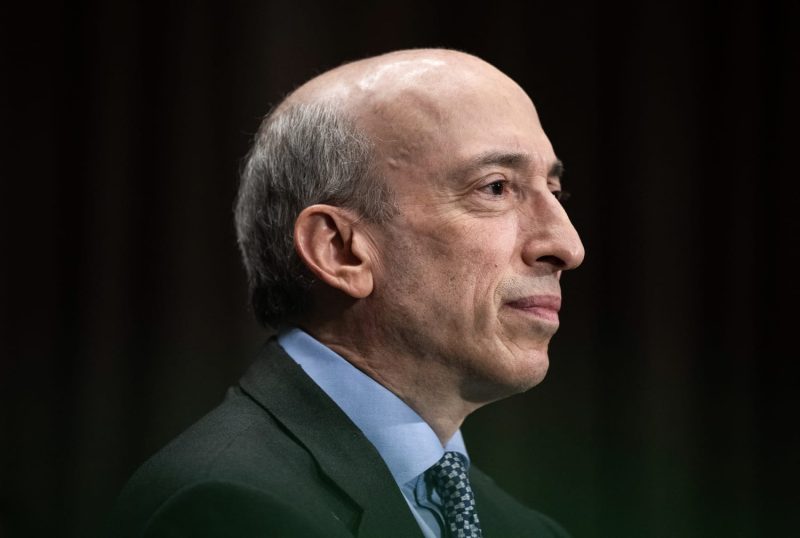

In a surprising turn of events, the Securities and Exchange Commission (SEC) Chair Gary Gensler has announced his decision to step down from his position, effective January 20th. This development has sparked speculation regarding potential changes in financial regulations and policies under the upcoming leadership. Gensler’s tenure as SEC Chair was marked by an emphasis on transparency, enforcement, and investor protection.

During his time at the helm of the SEC, Gensler prioritized addressing issues such as market manipulation, insider trading, and the protection of retail investors. He pushed for reforms aimed at enhancing the integrity of financial markets and ensuring a level playing field for all participants. Gensler’s aggressive approach to regulation often put him at odds with industry stakeholders, who criticized his stance on matters such as cryptocurrency oversight and climate risk disclosure.

As Gensler prepares to depart, speculation is rife about who will succeed him in leading the SEC. With the possibility of a replacement appointed by former President Donald Trump, there are concerns about a potential shift in regulatory priorities and enforcement strategies. The SEC plays a crucial role in safeguarding the integrity of the U.S. financial markets and protecting investors from fraud and misconduct. Any changes in leadership could have far-reaching implications for the regulatory landscape.

One key area of focus for the incoming SEC Chair will likely be the regulation of digital assets and cryptocurrencies. Gensler was known for his proactive stance on crypto oversight, advocating for clearer rules and investor protections in this rapidly evolving sector. The next SEC Chair will need to navigate the complexities of digital asset regulation while balancing innovation and investor safety.

Moreover, the new SEC Chair will also face challenges related to corporate governance, climate risk disclosure, and the ongoing fight against financial crimes. Maintaining the SEC’s independence and authority will be crucial in upholding the agency’s mission to protect investors and maintain fair, orderly, and efficient markets.

In conclusion, Gary Gensler’s decision to step down as SEC Chair marks the end of an era characterized by robust enforcement and a focus on investor protection. As the financial industry braces for a leadership transition at the SEC, stakeholders will be watching closely to see how the new Chair approaches key regulatory issues. The future direction of the SEC will have broad implications for market participants, investors, and the broader financial ecosystem.